Ahlian Jian Insights

Exploring the latest trends and news in various fields.

Banking on Change: How Your Choices Shape the Future

Unlock the future! Discover how your everyday choices in banking can reshape tomorrow's economy. Dive in now!

The Impact of Sustainable Banking Practices on Future Generations

Sustainable banking practices play a crucial role in shaping a better future for coming generations by fostering a healthier environment and promoting social equity. As financial institutions adopt more responsible lending criteria and investment strategies, they actively contribute to reducing carbon footprints and supporting eco-friendly projects. This shift not only helps combat climate change but also encourages businesses and individuals to embrace sustainable practices. Moreover, by prioritizing ethical investments, banks can drive innovation in green technologies, ensuring that the financial sector participates in the global effort to achieve sustainability goals.

Furthermore, sustainable banking establishes a framework for transparency and accountability, empowering future generations to hold financial institutions responsible for their actions. When banks commit to ethical practices, stakeholder engagement, and community development, they create a culture of trust that can lead to long-term financial stability. As younger generations become more aware of the social and environmental implications of their financial decisions, they will likely favor institutions that reflect their values. This shift in consumer behavior can ultimately reshape the landscape of banking, ensuring that the financial industry's evolution is aligned with the well-being of both people and the planet.

How Personal Financial Choices Can Drive Economic Change

The relationship between personal financial choices and larger economic shifts is profound. When individuals engage in sound financial practices, such as saving and investing, they contribute to overall economic stability. For instance, a rise in collective savings can bolster local banks, allowing them to lend more money to businesses, which can drive innovation and job creation. Conversely, poor financial decisions, such as excessive spending on credit, can lead to increased debt levels, negatively impacting not just individual households but the economy as a whole.

Moreover, personal financial choices also influence market trends and consumer behavior. When consumers decide to prioritize sustainable or ethically sourced products, they create a demand that can shift entire industries. For example, if a significant number of people choose to cut back on fast fashion in favor of eco-friendly brands, manufacturers will be compelled to adapt their practices accordingly. Such shifts demonstrate that individual decisions can indeed have a cascading effect, ultimately driving economic change in alignment with emerging consumer values and priorities.

What Role Do Consumers Play in Shaping the Future of Banking?

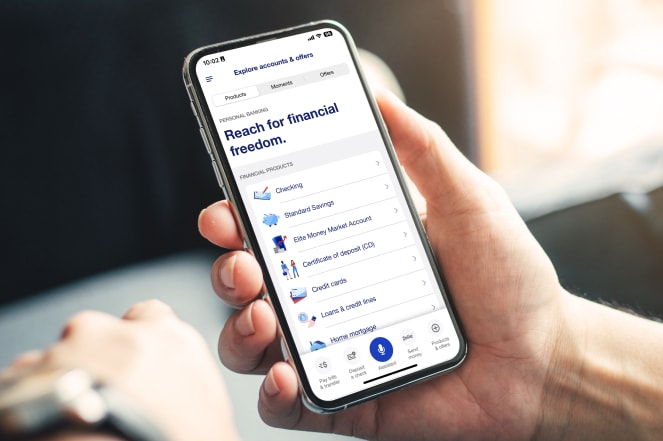

In the rapidly evolving landscape of banking, consumers are not just passive recipients of financial services; they are active participants who influence the direction of the industry. With the rise of digital banking and fintech companies, consumers have gained unprecedented power over how they manage their finances. Banks are increasingly focusing on customer experience and feedback to improve their services. This shift toward a consumer-centric approach means that the preferences and behaviors of users directly shape product offerings, leading to innovations like mobile banking apps, personalized financial advice, and seamless payment solutions.

Furthermore, the growing demand for transparency and ethical practices has prompted banks to rethink their operations. Consumers today seek trustworthy banking solutions that align with their values. As a result, many financial institutions are adopting sustainable practices and prioritizing customer data protection. In this way, consumers not only drive innovation but also foster accountability within the banking sector. As financial literacy increases among the general populace, the expectations placed on banks will evolve, pushing them to adapt continuously to a more informed and engaged customer base.