Ahlian Jian Insights

Exploring the latest trends and news in various fields.

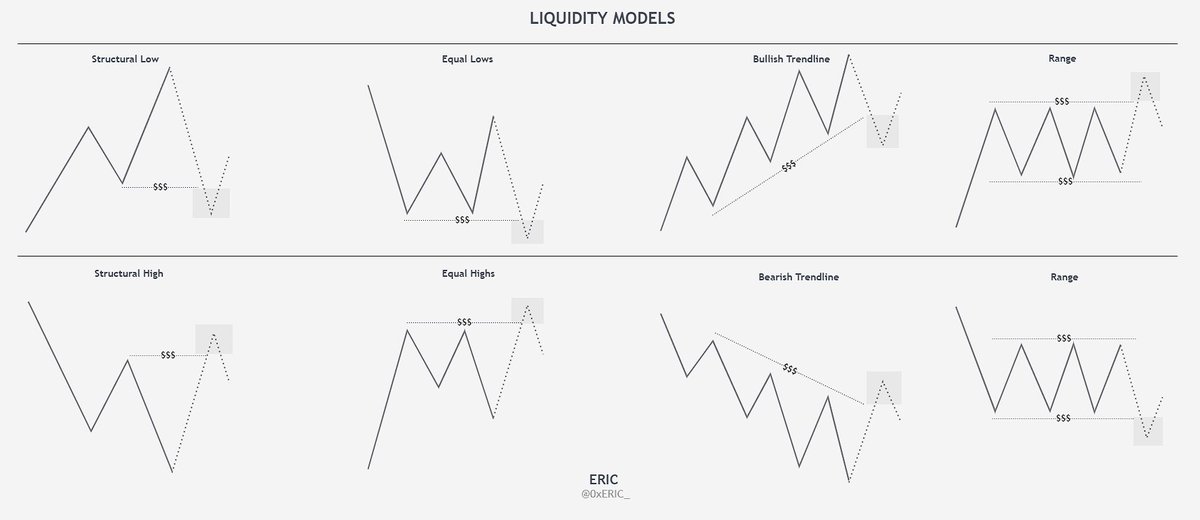

Marketplace Liquidity Models: Dancing with Demand and Supply

Discover the secrets behind marketplace liquidity models and how they juggle demand and supply. Dive in and unlock market success!

Understanding Marketplace Liquidity: Key Models and Concepts

Marketplace liquidity refers to the ease with which assets can be bought or sold in a market without affecting their price. It is a critical concept for both investors and traders as it directly influences transaction costs and market stability. There are several key models and concepts that help in understanding liquidity, including order books, where buyers and sellers post their orders, and market depth, which indicates the total volume of buy and sell orders at given price levels. A highly liquid market typically has a larger number of participants, tighter bid-ask spreads, and a greater volume of transactions.

One of the essential components of marketplace liquidity is the distinction between liquid and illiquid assets. Liquid assets, like stocks of large companies, can be quickly converted into cash, while illiquid assets, such as real estate or collectibles, may take longer to sell and could require a significant price reduction to attract buyers. Additionally, concepts like liquidity crisis and slippage demonstrate how market conditions can deteriorate quickly, making it important for market participants to understand liquidity dynamics. Recognizing these factors allows individuals and businesses to make more informed decisions when entering or exiting the marketplace.

Counter-Strike is a popular first-person shooter video game that has captivated players worldwide since its release. The game focuses on team-based gameplay, where players can take on roles such as terrorists or counter-terrorists. For players looking to enhance their gaming experience, using a daddyskins promo code can provide them with exciting in-game items and skins.

How Supply and Demand Shape Marketplace Liquidity

The relationship between supply and demand is fundamental in determining the liquidity of any marketplace. Liquidity refers to how easily assets can be bought or sold in the market without affecting their price. In a highly liquid market, a balance between supply and demand ensures that buyers and sellers can transact promptly. When demand outweighs supply, prices tend to rise, and increased activity can lead to greater liquidity as more participants enter the market seeking to capitalize on potential profits. Conversely, when supply exceeds demand, prices spiral downwards, often resulting in reduced trading volumes and diminished liquidity.

Understanding this dynamic allows traders and investors to navigate the marketplace more effectively. For example, during periods of high demand, liquidity can increase significantly; numerous buyers compete for limited assets, facilitating faster transactions. On the other hand, during downturns or when there is a surplus of assets, liquidity can suffer. To mitigate these fluctuations, market participants often look for indicators of supply and demand, such as historical price trends and trading volumes, to make informed decisions about when to enter or exit the market. Ultimately, comprehending how supply and demand shape marketplace liquidity is crucial for anyone involved in trading.

What Are the Best Strategies for Enhancing Marketplace Liquidity?

Enhancing marketplace liquidity is crucial for ensuring smoother transactions and attracting more participants. One effective strategy is to increase market depth by introducing more buyers and sellers, which can be achieved through targeted marketing efforts and incentives. Additionally, utilizing technology such as automated trading systems can facilitate faster transactions, reducing friction and encouraging more trades. Other methods include implementing dynamic pricing strategies that adapt to market conditions, allowing sellers to adjust prices in real time and creating a more responsive marketplace.

Another key strategy involves fostering a strong community around the marketplace. Engaging with users through forums, social media, and regular feedback sessions can enhance trust and loyalty, encouraging repeat business. Moreover, offering educational resources or webinars on best practices for trading can empower participants, thus increasing overall transaction volume. In conclusion, by focusing on market participation, utilizing technology, and building community, marketplaces can significantly enhance their liquidity and ensure long-term sustainability.